Nvidia and 2 Other Chip Stocks to Buy Following ‘Liberation Day,’ According to Analysts

President Donald Trump’s reciprocal tariffs have not spared even the high-flying chip industry, which powers various applications of artificial intelligence (AI) across industries. A key indicator of this has been the fall seen in the VanEck Semiconductor ETF (SMH). While the SMH ETF is down 16.3% on a YTD basis, the S&P 500 Index ($SPX) has corrected by a much lower 7.9%.

However, since the semiconductor industry remains on course to gain increasing traction in the coming years, analysts at Bank of America think the recent decline can be used as an opportunity to load up on the shares of companies with “solid balance sheets and strong fundamental exposure in AI, cloud, and complex computing.”

Considering this, chip giant Nvidia (NVDA) looks to be a solid bet at the current juncture. And so do these two other semiconductor stocks.

Let’s have a closer look at each of them now.

Chip Stock #1: Nvidia

If there is any company that most defines the AI megatrend, it is Nvidia (NVDA).

Nvidia specializes in GPUs, AI platforms, and high-performance computing solutions. Its products serve various sectors, including gaming, data centers, automotive, and professional visualization. Further, the company’s CUDA programming model has been instrumental in advancing AI research and applications.

With a market cap of $2.7 trillion, Nvidia is one of the most valuable companies in the world. However, the stock is down 17% on a YTD basis.

Nvidia boasts a set of strong fundamentals as evidenced from its latest quarterly numbers. Quarterly revenue hit a new record at $39.3 billion, marking a sharp 78% increase from the same period a year earlier. Earnings per share climbed 71% from the prior year to $0.89.

Aside from strong fundamentals, the company’s dominant position in the GPU market and the increased capital expenditures by hyperscalers on AI paves the way for future gains.

As highlighted in my previous analysis, Nvidia’s Blackwell and H100 GPUs represent the cutting edge of AI infrastructure, serving as “critical engines” behind advanced training and inference workloads. That the Blackwell lineup alone brought in $11 billion in revenue during its debut quarter is a clear indication of Nvidia’s dominant position.

What further elevates Nvidia’s standing is its ownership of the full technology stack. From the chip architecture and system software to the physical hardware used by virtually every major cloud provider and corporate client, Nvidia controls every layer. This kind of vertical integration is exceedingly rare in the tech industry and has already enabled the company to command premium pricing while maintaining robust margins.

Thus, analysts have deemed Nvidia stock a “Strong Buy” with a mean target price of $173.95, which denotes upside potential of about 55% from current levels. Out of 43 analysts covering the stock, 37 have a “Strong Buy” rating, two have a “Moderate Buy” rating, and four have a “Hold” rating.

Chip Stock #2: Cadence Design Systems

Cadence (CDNS) is a global leader in electronic design automation (EDA) and intelligent system design software and services. Its market cap is currently at $71.4 billion.

In 2025 so far, the stock is down 12.9%.

Cadence has been a consistent performer over the years, reporting steady growth. In the past 10 years, Cadence’s revenue and earnings have exhibited compound annual growth rates (CAGRs) of 11.37% and 20.85%, respectively. Notably, the most recent quarter saw the company report a beat on both revenue and earnings.

Revenues for the quarter came in at $1.36 billion, up from $1.07 billion in the year-ago period. Earnings shot up by 36.2% in the same period to $1.88 while also surpassing the consensus estimate of $1.82 per share. Further, this marked the 15th consecutive quarter of earnings beats from the company.

Cadence Design Systems presents a compelling case for long-term investors, owing to the durability of its revenue model and its entrenched leadership in analog semiconductor design. Its advantage is built on the strength of proprietary software and a well-integrated suite of tools tailored for both design and verification.

The company dedicates a notable portion of its earnings toward research and development, a strategic decision aimed at increasing the output of a highly constrained talent pool of silicon designers. By doing so, Cadence ensures it remains ahead of the curve in an industry where innovation cycles are accelerating and engineering talent is scarce.

In hardware verification, Cadence has carved out a unique position, most prominently with its Palladium verification systems. The relevance of this platform is underscored by remarks from Nvidia’s CEO, who noted that Palladium is the only piece of equipment he values more than his refrigerator. This system plays a pivotal role in simulating the behavior of sophisticated system-on-chip designs, a critical capability as the industry begins to anticipate chips with over a trillion transistors — something the Palladium Z3 is already built to address.

What further reinforces Cadence’s strategic position is its close collaboration with some of the most influential players in the semiconductor space, including Nvidia, Qualcomm (QCOM), and Broadcom (AVGO). These relationships, coupled with a business model that generates approximately 82%–83% of revenue from predictable, ratable sources as of 2024, provide Cadence with a high degree of financial visibility. This consistency in revenue allows for calculated, forward-looking investments that deepen the company’s competitive moat and strengthen its long-term prospects.

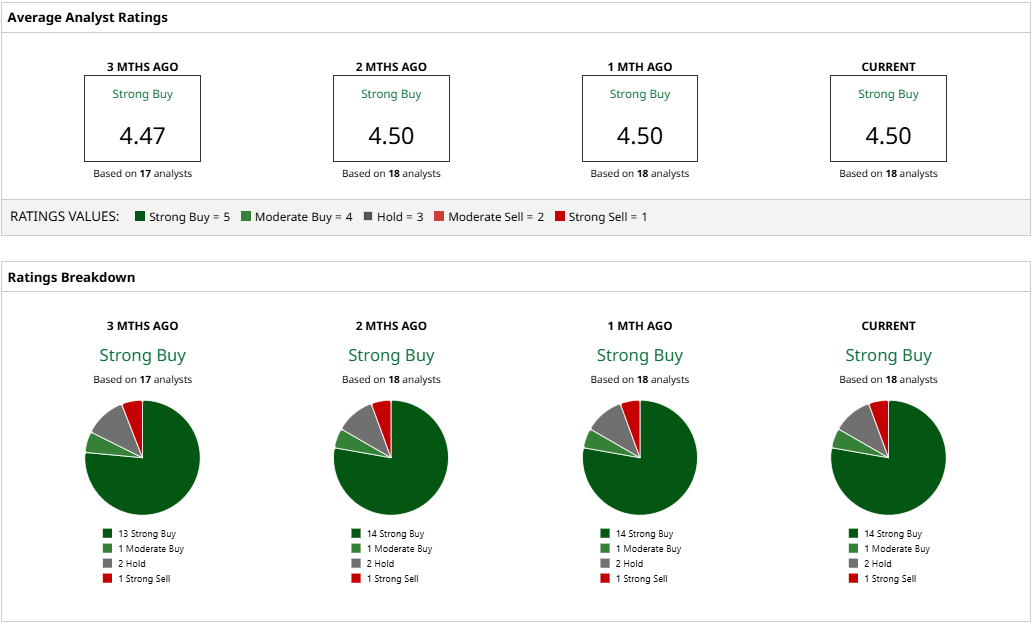

Considering this, analysts have attributed a rating of “Strong Buy” for the stock with a mean target price of $324.39, which indicates upside potential of roughly 24.5% from current levels. Out of 18 analysts covering the stock, 14 have a “Strong Buy” rating, one has a “Moderate Buy” rating, two have a “Hold” rating, and one has a “Strong Sell” rating.

Chip Stock #3: Lam Research

Lam Research (LRCX) is a leading global supplier of wafer fabrication equipment and services to the semiconductor industry. It specializes in designing and manufacturing equipment used in the fabrication of semiconductors. Its products are critical for processes such as etching and deposition, which are essential steps in the production of integrated circuits.

Valued at a market cap of $87.1 billion, LRCX stock is down 5% on a YTD basis.

Lam has seen impressive revenue and earnings growth over the past 10 years with CAGRs of 12.80% and 19.62%, respectively.

The most recent quarter also saw Lam's revenue and earnings come ahead of consensus estimates. Revenues for the quarter came in at $4.38 billion which denoted yearly growth of 16.5%. Earnings went up by 21% in the same period to $0.91, surpassing the consensus estimate of $0.88 while also marking the 11th consecutive quarter of earnings beats from the company.

The company has consistently shown a forward-looking approach in anticipating pivotal shifts in semiconductor design. One such inflection point was the move from traditional 2D NAND architecture to vertically stacked 3D NAND memory. The company identified this paradigm shift early and developed the manufacturing capabilities necessary to support the production of these next-generation memory chips — devices that retain stored data even when powered off. This transition has played a central role in the company’s revenue expansion since 2017. Today, the firm is preparing to benefit from a similar momentum, as demand for enhanced performance in DRAM and logic chips accelerates the industry-wide adoption of 3D structural frameworks in those segments as well.

DRAM, a temporary memory type found in consumer electronics such as smartphones, PCs, and tablets, loses its stored information once power is removed. To address new opportunities in both DRAM and 3D logic processing, the company recently launched two highly targeted solutions. The first is a material deposition system capable of layering molybdenum, a metal that offers superior electrical conductivity when compared with tungsten. This material improvement enables faster signal propagation — an essential advantage for high-throughput applications like generative artificial intelligence, advanced cloud workloads, and cutting-edge personal devices.

The second innovation is an advanced plasma etch platform, branded as Akara. This system allows for more refined control over the etching process, which is crucial for the intricate layering required in 3D semiconductor architectures. It also mitigates defect risks commonly associated with lithographic patterning, which involves projecting circuit patterns onto silicon wafers. By reducing these errors, the tool increases usable chip yield per wafer, improving overall manufacturing efficiency.

Ultimately, as chip designs grow increasingly complex to support AI and data-heavy computation, demand continues to rise for critical fabrication processes such as deposition, etch, and wafer cleaning. In this evolving landscape, the company’s leadership in etching technology provides a durable competitive edge — reinforced by its ability to command pricing premiums and maintain high customer retention due to the significant costs and complexity involved in switching to alternative providers.

Thus, analysts have assigned a rating of “Moderate Buy” for the stock with a mean target price of $95.77, which denotes upside potential of about 42% from current levels. Out of 29 analysts covering the stock, 19 have a “Strong Buy” rating, two have a “Moderate Buy” rating, and eight have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.