1 ‘Defensive’ Cathie Wood Stock to Buy While It’s at a ‘Great Entry Point’

DraftKings (DKNG), a popular sports betting company, has remained a favorite of many growth-oriented invstors since its 2020 IPO. The company has seen an incredible surge of interest as U.S. states increasingly legalize sports betting as a way to pad their budgets.

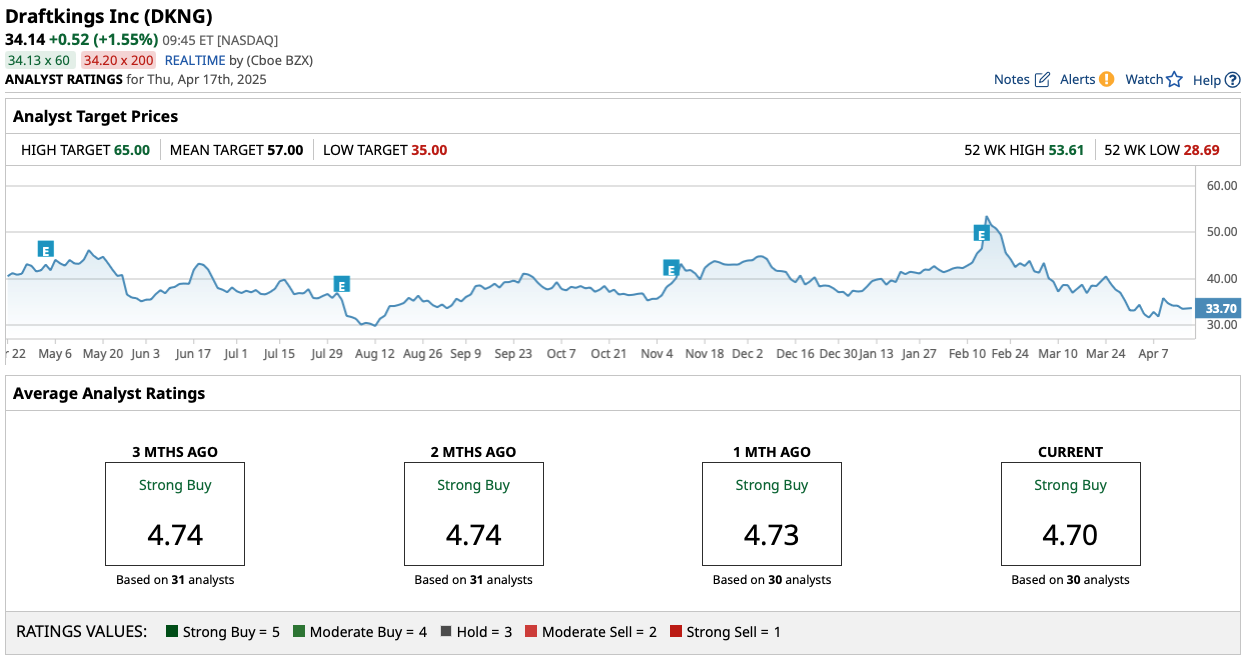

Of course, as you can see in the chart above, market sentiment has dictated DraftKings stock price action.

When investors have believed that the economy is firing on all cylinders, they have treated DraftKings as a growth stock with the ability to outperform. When investors become uncertain about the economy and move into more defensive names, the opposite is true.

For investors feeling bearish on the U.S. economy and stock market, DraftKings may seem like the perfect stock to avoid.

That said, there are a number of prominent investors such as Cathie Wood, the manager of Ark Invest, who continue to own DraftKings and believe DKNG is a great buy at current levels. And with some analysts now suggesting the outlook for DraftKings is improving materially, perhaps now is the time to take a deeper look.

So, let’s do just that.

Analyst Upgrade Spurs Interest in DraftKings Stock

CFRA analysts upgraded DraftKings this week from a “Hold” to “Buy,” suggesting that the sports betting company could be among the companies poised to benefit most from a continued regulatory shift. Regulatory winds have already lifted DraftKings, and a continued move from in-person gambling activity to online betting could continue to propel DraftKings’ revenue and earnings growth over time.

Perhaps more interesting for investors is CFRA’s discussion of the recent selloff in DraftKings stock and why investors may want to buy shares on the dip. With shares now trading at less than 3 times sales, analysts argue that it’s a “growth at a reasonable price” story.

DraftKings’ overall net income profile remains negative, and the company reported a loss per share of $1.05 in 2024.

However, looking at the company’s cash flow growth, it is clear that the company is realizing some hefty margins and is improving its operational efficiency metrics significantly. If DraftKings can continue on this track, there’s an argument to be made that it could outperform given the tailwinds behind the online sports betting sector.

Plenty will need to go right for DraftKings for this to happen. And there are key competitors that could eat into the company’s market share gains.

But for now, DraftKings is a leader in the sports betting industry. Investors who are bullish on betting and who are looking for high-quality companies with cash flow growth profiles may want to consider DKNG stock.

What Do Other Analysts Think?

When considering any stock, looking at where Wall Street analysts sit is generally considered to be a prudent exercise. And while analysts at CFRA are positive on DraftKings and the company’s future, rolling all existing analyst ratings together can provide a more holistic picture of where DraftKings could be headed.

Most analysts have “Strong Buy” ratings on the stock, with 24 of 30 analysts giving it a “Strong Buy” and three giving it a “Moderate Buy” rating. The average price target of $57 also implies significant upside potential of 72% from here.

It’s also worth noting that DKNG stock is now trading right near its Street-low price target, meaning downside may be limited from here.

Given the plethora of positive factors supporting DraftKings’ outlook, in combination with these anlayst ratings, I think there’s a solid case to be made that growth investors should give DraftKings a look here.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.